When you have any sort of long-variety economic purpose under consideration, shelling out is likely to be required to do it. No matter whether the ideal is retirement life or mailing a child to university, you are greatest off allowing your money increase alone after a while. Keep reading to learn some basic principles about making an investment your money.

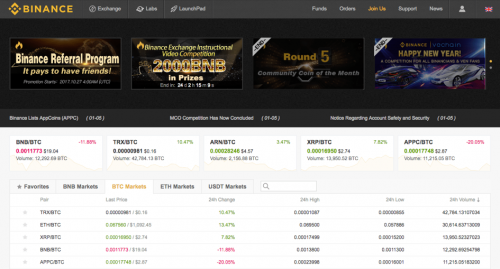

Before you start making an investment, acquire supply of your market place and do your research on qualities. Take 바이낸스 가입방법 at involving 50 along with a hundred or so properties in the region useful. Do a comparison making use of excellent note consuming as well as a distribute sheet. Rent payments requirements, prices and fix finances should be aspects you're contemplating. This can help you make a decision what bargains are the best.

Marketing will be important to your prosperity. Marketing and advertising is exactly what creates your sales opportunities. Without having reliable prospects, you are not going to get great deals on properties. Therefore, if one thing is not really operating in your expenditure program, choose your online marketing strategy first to see what is going on and what could be modified.

Talk to other real estate brokers. It's essential to get in touch with other folks and get guidance from those more knowledgeable than on your own. Their knowledge can prevent you from generating blunders and save you some cash. You can get many more through the Internet. Discover message boards to get active on and locate meetings in your town.

You might want to use a residence management assistance. This can cost a small but will help a lot in the end. These companies will assist you to locate reasonable tenants, and in addition care for any injuries. This liberates up time to look for more qualities.

Don't go into real-estate committing unless of course you're in a position to get some support funds. Location money aside to fund small improvements. One additional basis for getting extra income is in the event you can't locate a suitable renter as soon as possible. You continue to need to have to take into account the price of residence even though no one is dwelling there.

Search for qualities that can be needed. Really stop and consider what the majority of people is going to be trying to find. Try to look for moderately costed qualities on calm avenues. Searches for homes with garages and several rooms. It's always important to consider exactly what the average particular person will likely be in search of at home.

Status is essential in the shelling out entire world. As a result, always explain to the simple truth and do not make any opponents. Most importantly, follow through of what you say you will do. Should you be unclear whenever you can take steps, will not make the declare to begin with. Your track record could endure and affect your business consequently.

Can be your place suffering from a property worth increase? Do you see vacancies the location where the places are now being rented? These are a couple of questions you should ask yourself. You want to ensure there exists a requirement for renting in the area where you get.

Usually monitor your renters. Knowing who you are likely to be booking your components to is very important. Manage a background verify. Make sure they don't use a spotty and abnormal record with paying out their lease by the due date. Finding out relating to your tenant's record can save you a great deal of problems in the future.

Whenever you buy real-estate, take care not to around-commit. You happen to be more well off beginning on the small-scale than getting in around your face at the start. You don't desire to diminish your cost savings. Do not make it your fulltime work quickly. Once you have been successful, you may modify your technique.

It's tempting to jump straight into the real estate market place, but that strategy could be very unsafe. Quite, you should start with small purchases, then development to bigger purchases. This way, you will also have an economic cushion and should never be wiped out by one particular misstep or streak of terrible market luck.

Watch out for any excitement in regards to a specific part of property. It does not matter how great the sales pitch noises. It depends on anyone to do comprehensive analysis about the component of property to ensure that it can be correctly represented. Acquiring residence dependent strictly on excitement is surely an imprudent decision.

Recurrent Internet investment message boards. You are going to have the capability to learn a great deal from those with lots of practical experience. You will get the opportunity to inquire from people who have been investing for a long period. This type of purchase neighborhood is normally rather helpful. New brokers often find these teams to be very useful.

Constantly understand the dangers that you are currently coping with. Typically, the higher the danger, the larger the prospective payoff is going to be. But as well as that higher risk also comes a bigger possibility of not making any money in any way. So assess the threat degree and make sure it is within your comfort region.

Try to find investments offering taxation advantages. According to the purchase endeavor, there might be particular tax rewards. Ties are a good demonstration of a good investment that be eye-catching for the reason that profits on them can be income tax exempt. So element into individuals conserving when determining the gains which a business might have to suit your needs.

Keep the objectives sensible. Don't count on assets leading you to abundant. That's a very unlikely final result. Keep your objectives acceptable versions. You can nevertheless make a considerable amount of funds away from purchases, even should it be less likely to be a lot of money. Congratulate oneself for little successes rather than allowing them to dissuade you.

If you are investing in shares, then inform yourself about how the ups and downs of your market place are. Then when your stocks success a "lower" time period, you wont be panicked and try to offer at a loss. Tugging your hard earned dollars out too rapidly is a kind of oversight made by beginner traders.

Sooner or later in your lifestyle you are likely to think about huge monetary target you should do from the much future. This can be creating your home egg or mailing a child to your excellent school. You may take on this sort of pricey objectives by committing funds over time. Use the information and concepts of this article to create your potential desires a growing actuality.