If you have any kind of extended-array fiscal target in your mind, shelling out is probably going to be required to do it. Regardless if your perfect is retirement life or mailing a child to university, you are greatest off of permitting your cash develop by itself as time passes. Read on to find out some basics about committing your financial situation.

Before you start committing, get carry of your market and shop around on components. Have a look at involving 50 along with a hundred qualities in the community of great interest. Compare them making use of very good take note using along with a spread out sheet. Hire requirements, rates and repair financial budgets needs to be variables you're thinking of. This will help you determine what bargains are the most useful.

Marketing will be crucial to your prosperity. Advertising and marketing is what generates your leads. Without having strong sales opportunities, you are not going to get great deals on qualities. Therefore, if anything is just not operating in your purchase prepare, consider your marketing plan very first to view what is going on and exactly what can be altered.

Speak with fellow real estate brokers. It's important to reach out to others and obtain advice from all those more experienced than oneself. Their knowledge can stop you from generating faults and help save some funds. You will discover numerous others through the Internet. Discover forums to get productive on and locate meetings in your town.

You may want to utilize a home management services. This will cost a small and can help a lot in the long run. These companies can help you find reasonable renters, plus care for any damages. This liberates up time to find a lot more qualities.

Don't get into real estate property committing unless you're capable to have some backup money. Location money besides to fund small fixes. Another good basis for experiencing additional money is in the event you can't look for a ideal renter at the earliest opportunity. You will still need to think about the price of home even when nobody is living there.

Look for components that can be in demand. Actually quit and think about what 비트코인 하는법 will be looking for. Look for modestly valued components on tranquil avenues. Actively seeks properties with garages and 2 or 3 rooms. It's usually crucial that you think about what the regular particular person will probably be trying to find in a home.

Status is important within the making an investment planet. Therefore, usually tell the facts and try not to make any enemies. Most of all, follow-through of what you say you are likely to do. When you are uncertain when you can take steps, usually do not have the state to begin with. Your track record could experience and affect your organization for that reason.

Can be your region suffering from a property importance raise? Can you see vacancies where the locations are rented? These are several questions to ask your self. You need to be sure you will find a interest in renting in the community that you purchase.

Constantly monitor your renters. Knowing who you will be booking your components to is essential. Have a history check. Make certain they don't use a spotty and abnormal historical past with paying their rent punctually. Learning about your tenant's background can help you save a great deal of trouble in the future.

Once you purchase property, be careful not to more than-spend. You are happier starting on a small-scale than getting in over your head in the beginning. You don't wish to deplete your financial savings. Do not allow it to be your regular work right away. After you have been effective, you are able to modify your approach.

It's tempting to leap directly into the real estate marketplace, but that approach could be very dangerous. Quite, you can start with small assets, then progress to larger assets. In this manner, you are going to usually have a monetary pillow and will never be wiped out by a single misstep or streak of awful marketplace fortune.

Watch out for any hype with regards to a particular bit of house. It does not matter how very good the sales pitch noises. It is perfectly up to you to definitely do detailed investigation in the component of home to make sure that it really is effectively depicted. Getting home structured solely on excitement is undoubtedly an foolish decision.

Regular World wide web investment community forums. You will have the capacity to understand a whole lot from those with lots of encounter. You will get the opportunity to make inquiries from anyone who has been making an investment for some time. This sort of purchase group is usually rather accommodating. New investors often discover these teams to be really helpful.

Constantly are aware of the risks that you will be dealing with. Generally, the larger the chance, the bigger the prospective payoff is going to be. But together with that greater risk also is available a larger potential for not making any dollars whatsoever. So look at the threat level and make sure it is in your ease and comfort sector.

Search for assets offering tax positive aspects. Based on the investment endeavor, there can be specific tax advantages. Ties are a wonderful illustration of a good investment that be eye-catching because the profits upon them may be income tax exempt. So factor into individuals preserving when assessing the gains that a endeavor might have for yourself.

Make your expectations practical. Don't count on ventures causing you to wealthy. That's a really not likely final result. Maintain your expectations reasonable ones. You may continue to make a large amount of funds off of purchases, even when it is not likely as a fortune. Congratulate on your own for tiny accomplishments rather than allowing them to dissuade you.

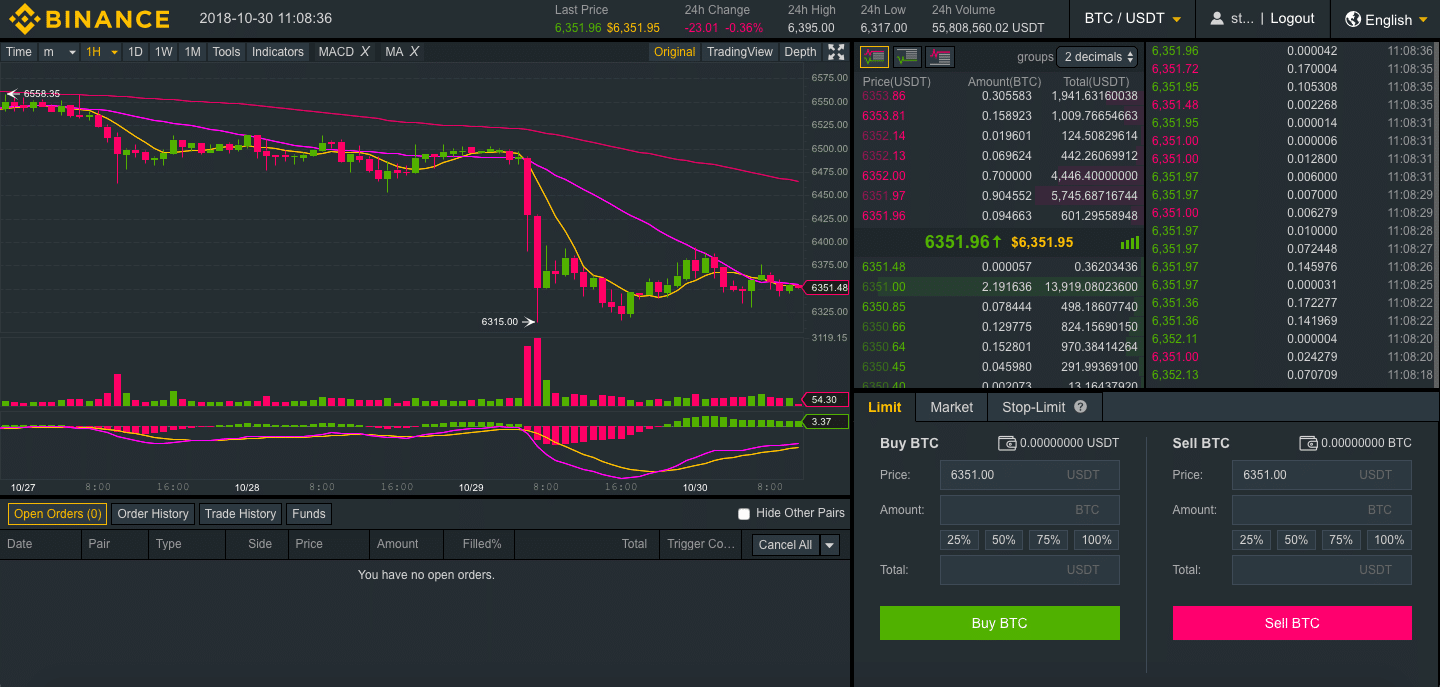

If you are buying stocks, then keep yourself well-informed about how exactly the highs and lows in the market are. When your stocks and shares struck a "straight down" period, you wont be panicked and attempt to sell at a loss. Taking your cash out too quickly is a type of blunder created by novice brokers.

In the course of your life you are likely to consider a major fiscal goal for you to do in the considerably potential. This can be putting together your nest ovum or sending a kid to your excellent university. It is possible to handle this kind of expensive targets by investing cash over time. Utilize the knowledge and ideas of the write-up to help make your future desires a growing fact.