When you have any type of very long-array monetary goal in mind, shelling out is probably going to be necessary to achieve it. Whether or not your perfect is pension or mailing a youngster to college, you might be greatest off of making your hard earned money expand alone after a while. Please read on to understand some basic principles about committing your money.

Before beginning committing, take inventory of your industry and seek information on attributes. Have a look at in between 50 as well as a hundred components in your community of interest. Compare them using good be aware using along with a spread sheet. Lease requirements, prices and fix finances needs to be variables you're thinking of. This should help you choose what discounts are the most effective.

Advertising and marketing will probably be crucial to ensuring your success. Marketing is the thing that produces your leads. With out solid prospects, you are not likely to discover discounted prices on properties. For that reason, if one thing is not working in your expense program, turn to your online marketing strategy initial to discover what is happening and what could be adjusted.

Consult with fellow real-estate traders. It's vital that you reach out to other individuals and obtain assistance from these more experienced than oneself. Their understanding can keep you from producing errors and help save a few bucks. You can get many others through the Internet. Get discussion boards to become lively on and discover meetings in your town.

You may want to work with a property managing service. This will cost a small and often will be very convenient in the end. These businesses can help you discover good tenants, plus deal with any injuries. This liberates up time to find much more qualities.

Don't enter into real estate investing unless you're able to possess some back cash. Position dollars away to cover small fixes. One additional reason for getting extra money is if you happen to can't look for a suitable renter without delay. You continue to need to take into account the price of house regardless of whether no one is lifestyle there.

Look for properties that might be in demand. Truly stop and think about what a lot of people will be seeking. Try to find modestly priced properties on tranquil streets. Actively seeks homes with garages and a couple of bed rooms. It's always vital that you think about just what the regular man or woman will probably be trying to find in a home.

Status is very important in the committing entire world. As a result, usually explain to the facts and try not to make any opponents. Most of all, follow through about what you say you will do. When you are unclear if you can take steps, will not make the declare in the first place. Your track record could experience and affect your organization as a result.

Will be your place experiencing a house value improve? Can you see vacancies where locations are rented? These are some things to ask on your own. You need to make sure there exists a requirement for renting in the area that you buy.

Usually monitor your renters. Understanding who you are going to be renting your attributes to is important. Manage a backdrop check out. Ensure they don't use a spotty and unusual background with having to pay their hire on time. Determining relating to your tenant's record will save you plenty of issues in the future.

Once you get real estate property, take care not to more than-devote. You happen to be better off starting with a small scale than getting into over the head at the start. You don't desire to diminish your financial savings. Usually do not allow it to be your regular task quickly. After you have been profitable, you are able to modify your strategy.

It's tempting to jump straight into the real estate marketplace, but that method can be quite dangerous. Somewhat, you can start with modest purchases, then development to greater assets. In this way, you will usually have an economic pillow and will never be wiped out by one particular misstep or streak of bad marketplace luck.

Avoid any buzz with regards to a specific bit of property. It makes no difference how excellent the sales pitch appears to be. It depends on anyone to do comprehensive study in the component of property to ensure it really is precisely depicted. Buying house dependent purely on hoopla is an imprudent choice.

Recurrent Internet expense community forums. You are going to have the capability to find out a great deal from those with a lot of practical experience. You will have a chance to make inquiries from those who have been investing for a long period. This particular investment local community is often very helpful. New brokers usually locate these groups to become extremely beneficial.

Always are aware of the threats that you are currently handling. Usually, the better the danger, the bigger the potential payoff will probably be. But along with that greater risk also is available a larger potential for not making any dollars in any way. So measure the danger levels and ensure it is within your comfort and ease zone.

Look for purchases offering income tax positive aspects. Based on the expenditure business, there may be certain tax rewards. Bonds are a good instance of a smart investment that be appealing for the reason that results on them can be taxation exempt. So component into all those protecting when examining the results that a enterprise could have for you personally.

Maintain your requirements practical. Don't count on investments making you unique. That's an extremely not likely outcome. Keep the requirements acceptable kinds. You can still make plenty of funds from assets, even when it is improbable to become fortune. Congratulate your self for little accomplishments as an alternative to letting them intimidate you.

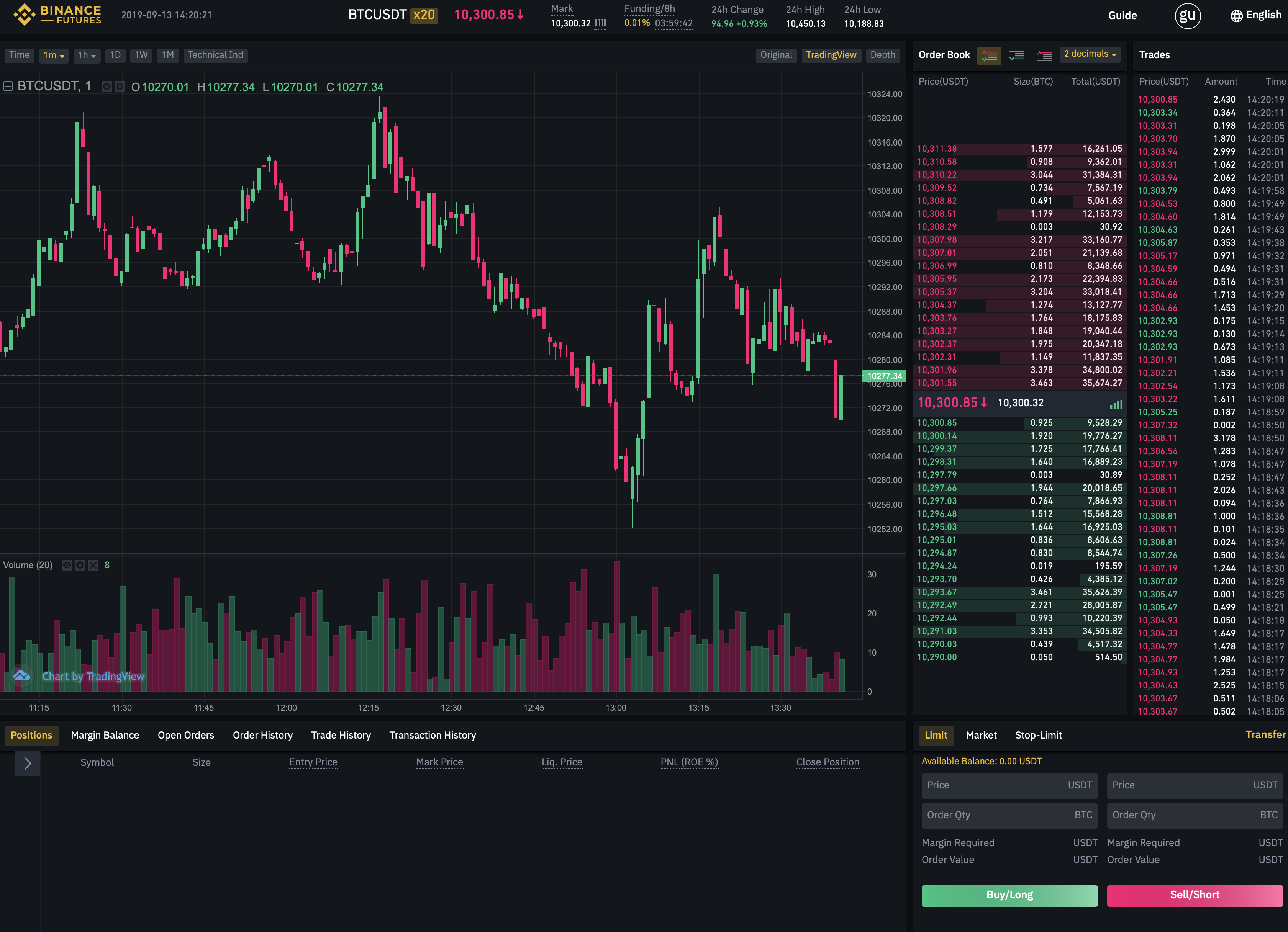

If you are making an investment in stocks and shares, then educate yourself about how exactly the ups and downs of the market place are. When 바이낸스 비트코인 and shares hit a "downward" time period, you will not be panicked and then try to market at a loss. Tugging your money out too rapidly is a kind of error manufactured by novice investors.

At some stage in your way of life you might consider a large monetary objective you wish to do inside the far upcoming. This might be creating your nest egg or giving a young child to a excellent university. It is possible to deal with this kind of expensive objectives by investing funds after a while. Use the wisdom and concepts with this write-up to help make your future ambitions an expanding actuality.